Sustainability performance

In Fiscal 2023, Sodexo’s solid financial performance was accompanied by continued progress on its sustainability commitments.

Several important features this year were:

1. Record performance on safety of our People

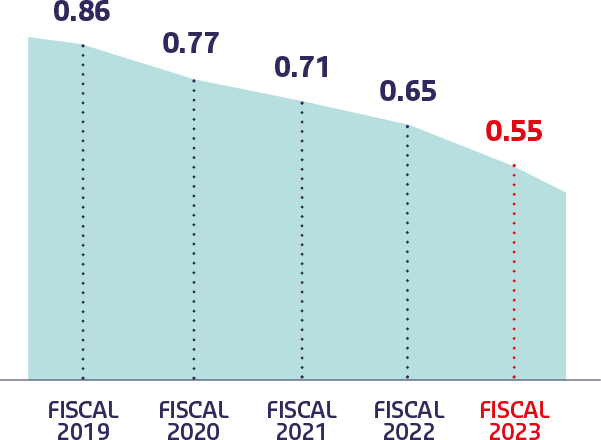

At the end of Fiscal 2023, Sodexo reached a record 0.55 Lost Time Injury Rate (LTIR), representing a -15.4% reduction compared to Fiscal 2022. The severity of Lost time injuries also reached a record level reduction of -52% compared to the previous year.

-15.4% reduction of LTIR compared to Fiscal 2022.

LTIR EVOLUTION OVER 5 YEARS

This graph shows the LTIR evolution over 5 years.

Fiscal 2019: 0.86

Fiscal 2020: 0.77

Fiscal 2021: 0.71

Fiscal 2022: 0.65

Fiscal 2023: 0.55

2. Employee engagement confirming renewed confidence in Sodexo and its trajectory

For the 10th engagement survey, the participation rate reached an all-time high of 72.9%, up +10.3 points compared to the 2021 survey, with 239,000 participants across the Group. The engagement rate was 82.5%, up +4.2 points compared to 2021, exceeding the 2025 objective of 80%.

82.5% Employee Engagement Rate

3. Increased share in renewable electricity in our direct operations

Further progress has been achieved in the share of the Group’s direct electricity consumption that is renewable at 55%, well above the 40% target for the year, on track for the achievement of our target of 100% by 2025.

55% Renewable electricity in our direct operations

4. The continuation of the carbon trajectory

In Fiscal 2023, Sodexo records year-on-year reduction in GHG emissions (scopes 1, 2 and 3) of -5.4% and -20.7% vs. 2017. Scope 1 and 2 GHG emissions are down -32.9% relative to the new 2017 baseline, and are on track to reach our reduction target of -34% in 2025.

-5,4% year-on-year reduction in scope 1, 2 and 3 emissions

Sodexo share data sheet

- Main listing place: Euronext Paris - A Compartment

- ISIN code: FR0000121220

- Mnemonic code: SW

- Main indices : CAC Next 20, SBF 120, CAC 40 ESG, CAC 40 1.5, Euronext 100, CAC All Share, FTSE4Good, ESG 80, and the Dow Jones Sustainability Index.

- Euronext listing date: March 2, 1983

- S&P rating stable at BBB+/A-2

Key indicators

(as of August 31, 2023)

- Total number of shares: 147,454,887 shares

- Closing price: 99.02 euros

- Market capitalization: 14.6 billion euros

- Sodexo share price trend during Fiscal 2023: +30.3%

- CAC 40 trend during Fiscal 2023: +17.4%

- Underlying earnings per share: 6.21 euros

- Dividend per share, submitted for approval at the Shareholders Meeting of December 15,2023: 3.10 euros

For more information, see chapter 3 of the Universal Registration Document.