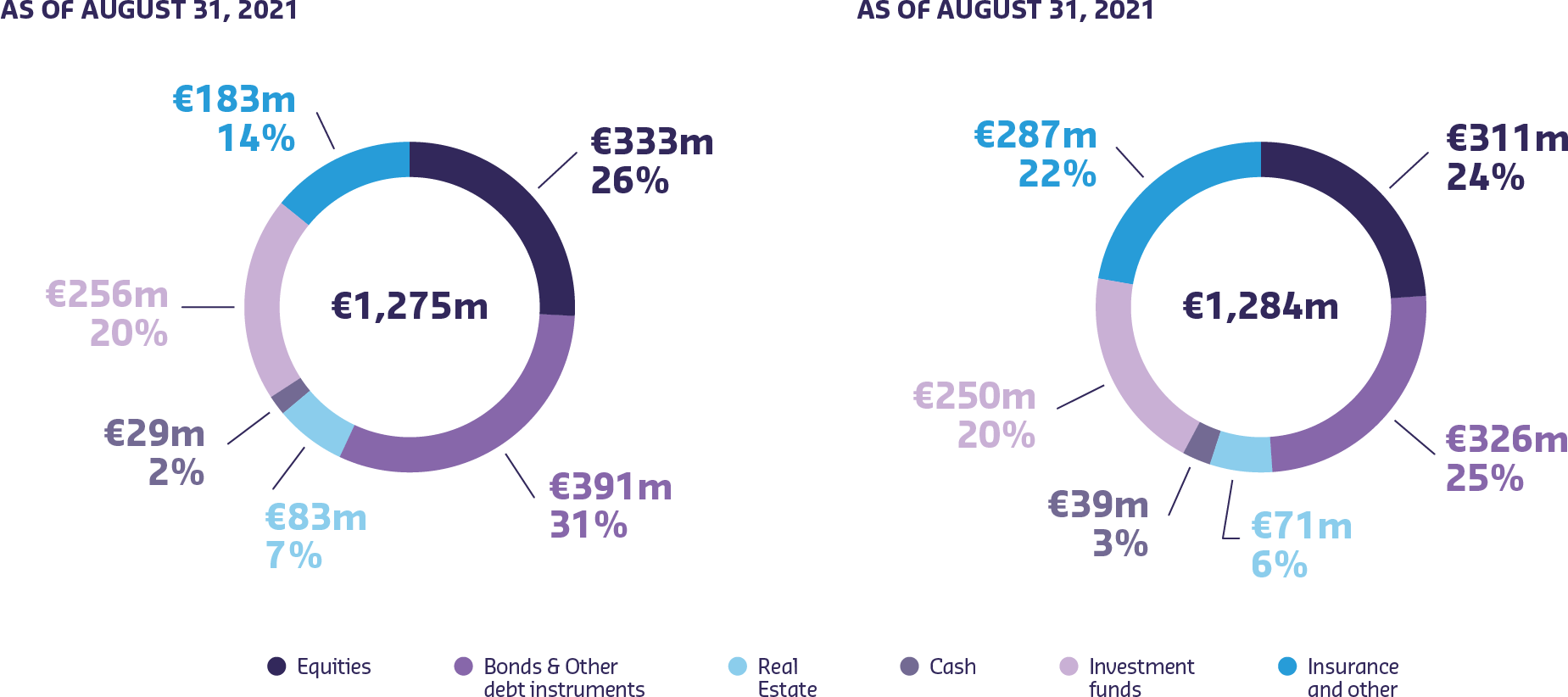

Defined benefit plan assets comprise :

AS OF AUGUST 31, 2021

€1.275m

Equities : €333m, 26%

Bonds & Other debt instruments : €391m, 31%

Real Estate : €83m, 7%

Cash : €29m, 2%

Investment funds : €256m, 20%

Insurance and other : €183m, 14%

AS OF AUGUST 31, 2020

€1.284m

Equities : €311m, 24%

Bonds & Other debt instruments : € 326m, 25%

Real Estate : €71m, 6%

Cash : €39m, 3%

Investment funds : €250m, 20%

Insurance and other : €287m, 22%

Recognized net actuarial gains arising from changes in financial assumptions amounted to 59million euro, of which 53 million euro in the United Kingdom. In the United Kingdom, these gains were mainly due to the updated discount rate.

The following assumptions were used for actuarial valuations for the principal countries as of August 31, 2021 and 2020 :

| AUGUST 31, 2021 | FRANCE | NETHERLANDS | UNITED KINGDOM | ITALY |

|---|---|---|---|---|

| Discount rate(1) | Discount rate (1)FRANCE1.05% |

Discount rate (1)NETHERLANDS0.8% |

Discount rate (1)UNITED KINGDOM1.7% |

Discount rate (1)ITALY0.35% |

| Salary long-term inflation rate(2) | Salary long-term inflation rate (2)FRANCE2.25% |

Salary long-term inflation rate (2)NETHERLANDSN/A |

Salary long-term inflation rate (2)UNITED KINGDOM3.8% |

Salary long-term inflation rate (2)ITALYN/A |

| General long-term inflation rate | General long-term inflation rate FRANCE1.75% |

General long-term inflation rate NETHERLANDS1.75% |

General long-term inflation rate UNITED KINGDOM3.3%(3) |

General long-term inflation rate ITALY1.75% |

| Net liability (in millions of euro) | Net liability (in millions of euro) FRANCE87 |

Net liability (in millions of euro) NETHERLANDS2 |

Net liability (in millions of euro) UNITED KINGDOM(9) |

Net liability (in millions of euro) ITALY17 |

| Average term of the plans (in years) | Average term of the plans (in years) FRANCE9 |

Average term of the plans (in years) NETHERLANDS18 |

Average term of the plans (in years) UNITED KINGDOM19 |

Average term of the plans (in years) ITALY6 |

(1) Discount rates in each country have been adjusted to reflect the term of the plans. For the euro zone and the United Kingdom, the Group uses discount rates based on yield curves for high quality corporate bonds drawn up by an external actuary.

(2) The salary inflation rate disclosed includes general inflation.

(3) Retail Price Index (RPI): 3.30%; Consumer Price Index (CPI): 2.55% for Fiscal 2021.

| AUGUST 31, 2020 | FRANCE | NETHERLANDS | UNITED KINGDOM | ITALY |

|---|---|---|---|---|

| Discount rate (1) | Discount rate (1)FRANCE1.2% |

Discount rate (1)NETHERLANDS0.95% |

Discount rate (1)UNITED KINGDOM1.7% |

Discount rate (1)ITALY0.65% |

| Salary long-term inflation rate(2) | Salary long-term inflation rate (2)FRANCE2.25% |

Salary long-term inflation rate (2)NETHERLANDSN/A |

Salary long-term inflation rate (2)UNITED KINGDOM3.4% |

Salary long-term inflation rate (2)ITALYN/A |

| General long-term inflation rate | General long-term inflation rate FRANCE1.75% |

General long-term inflation rate NETHERLANDS1.75% |

General long-term inflation rate UNITED KINGDOM2.1% - 2.9%(3) |

General long-term inflation rate ITALY1.75% |

| Net liability (in millions of euro) | Net liability (in millions of euro) FRANCE87 |

Net liability (in millions of euro) NETHERLANDS1 |

Net liability (in millions of euro) UNITED KINGDOM4 |

Net liability (in millions of euro) ITALY18 |

| Average term of the plans (in years) | Average term of the plans (in years) FRANCE9 |

Average term of the plans (in years) NETHERLANDS19 |

Average term of the plans (in years) UNITED KINGDOM19 |

Average term of the plans (in years) ITALY8 |

(1) Discount rates in each country have been adjusted to reflect the term of the plans. For the euro zone and the United Kingdom, the Group uses discount rates based on yield curves for high quality corporate bonds drawn up by an external actuary.

(2) The salary inflation rate disclosed includes general inflation.

(3) Retail Price Index (RPI): 2.9%; Consumer Price Index (CPI): 2.1% for Fiscal 2020 .

(4) Excluding 104 million euro in retirement benefit obligations in the 6 UK companies (offset by an asset in the same amount).

With respect to the assumptions provided in the above table, for Fiscal 2021, a reduction of 1% in the discount rate would increase the gross obligation to 1,718 million euro (compared with 1,435 million euro based on the assumptions used as of August 31, 2021), while a rise of 0.5% in the general long-term inflation rate would increase the gross obligation to 1,529 million euro.

Multiemployer plans

Based on estimates derived from reasonable assumptions, Sodexo will pay 19 million euro into defined benefit plans in Fiscal 2022.

In the USA, as of August 31, 2021, Sodexo contributed to 78 multiemployer defined benefit pension plans under the terms of collective-bargaining agreements (“CBA”) that cover its union-represented employees. The risks of participating in these multiemployer plans are different than those of single-employer plans in the following respects:

- assets contributed to the multiemployer plan are used to provide benefits to all beneficiaries of the plan, including beneficiaries of other participating employers;

- if a multiemployer plan is considered to be in “critical” status as defined by the U.S. Pension Protection Act of 2006, the plan will be required to adopt a rehabilitation plan which may require the Company to increase its required contributions to the plan;

- if a participating employer ceases to contribute to the plan, the unfunded obligations of the plan may have to be borne by the Company and the other remaining participating employers; and

- if the Company ceases to participate in a multiemployer plan, entirely or partially in excess of a threshold, or if substantially all of the participating employers of a given plan cease to participate, the Company may be required to pay that plan an amount based on the value of unfunded vested benefits of the plan and the Company’s pro-rata share of total plan contributions, referred to as withdrawal liability.