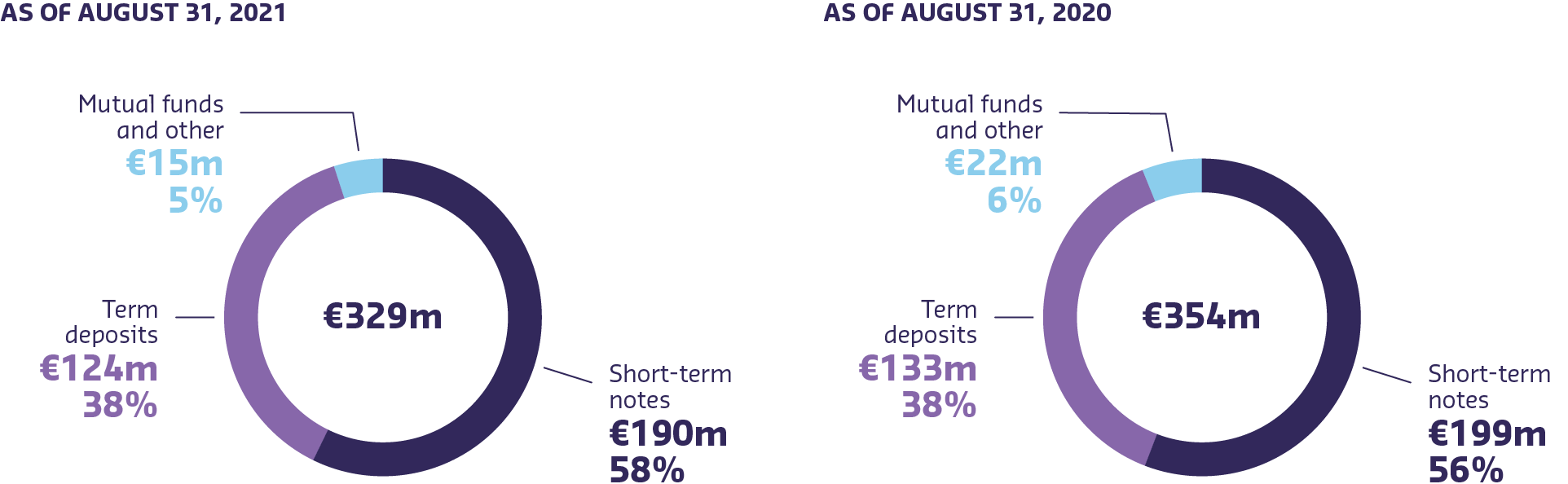

Marketable securities comprised :

AS OF AUGUST 31, 2021

Total of €329m, of which:

Short-term notes: €190m, 58%

Term deposits: €124m, 38%

Mutual funds and other: €15m, 5%

AS OF AUGUST 31, 2020

Total de 354 m€, dont :

Short-term notes: €199m, 56%

Term deposits: €133m, 38%

Mutual funds and other: €22m, 6%

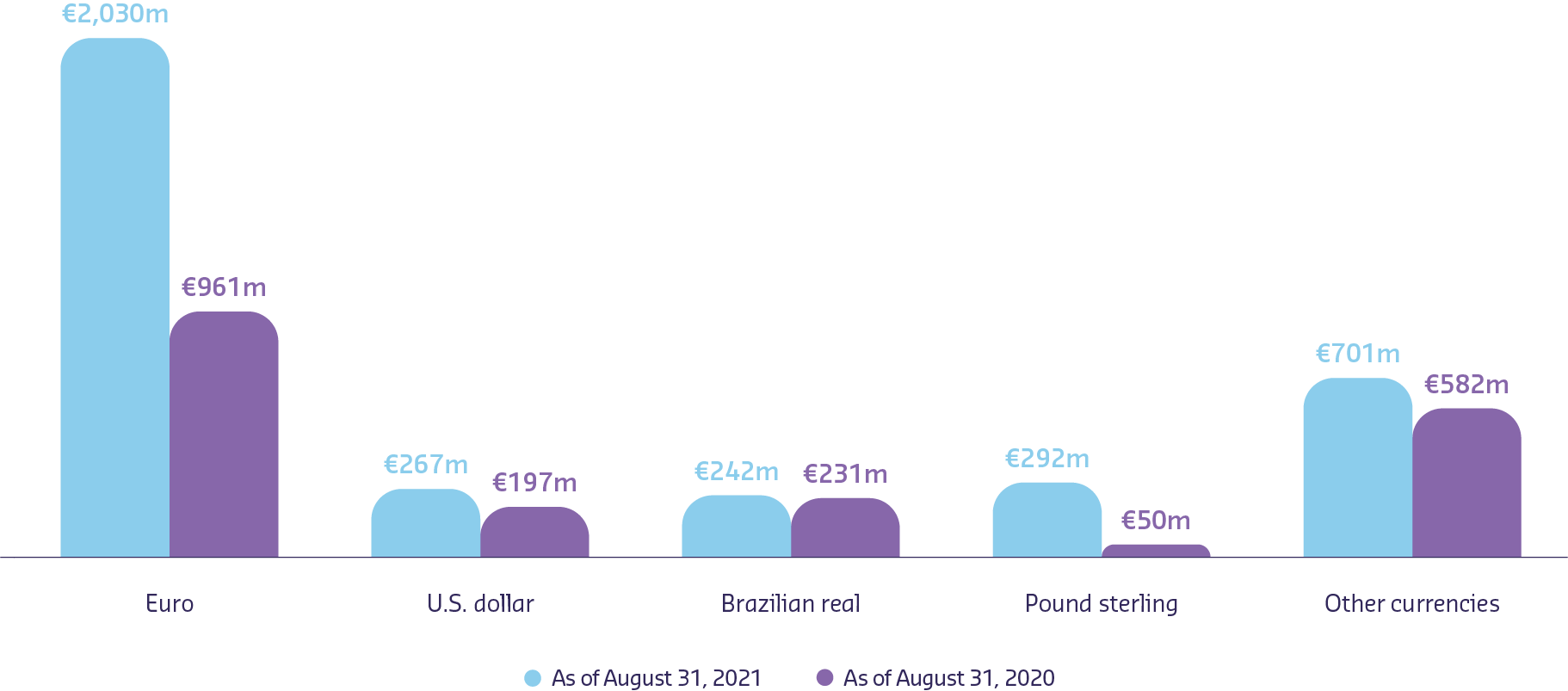

Cash, cash equivalents and overdraft break down as follows by currency :

Euro : As of August 31, 2021 : €2,030m, As of August 31, 2020 : €961m.

U.S. dollar : As of August 31, 2021 : €267m, As of August 31, 2020 : €197m.

Brazilian real : As of August 31, 2021 : €242m, As of August 31, 2020 : €231m.

Pound sterling : As of August 31, 2021 : €292m, As of August 31, 2020 : €50m.

Other currencies : As of August 31, 2021 : €701m, As of August 31, 2020 : €582m.

This currency allocation is presented after clearing the positive and negative positions of the Group's two cash pools with an asset position of 3,226 million euro and a liability position of 22 million euro as of August 31, 2021.

More than 85% of the Group’s cash and cash equivalents, restricted cash and financial assets related to the benefits & Rewards Services activity, is held with A+, A1- or A2-rated financial institutions.

No significant amount of cash or cash equivalents was subject to any restrictions as of August 31, 2021 .