12.4.4 Interest rates

In order to comply with the Group’s financing policy, substantially all borrowings are long term and at fixed interest rates.

As of August 31, 2021, 95% of the Group’s borrowings were at fixed rate. The average rate of interest as of the same date was 1.6%.

As of August 31, 2020 , 100% of the Group’s borrowings were at fixed rate. The average rate of interest as of the same date was 1.6%.

The bond issues and borrowings from financial institutions described above include customary early redemption clauses. These clauses include cross-default and change-in-control clauses which apply to all of the borrowings.

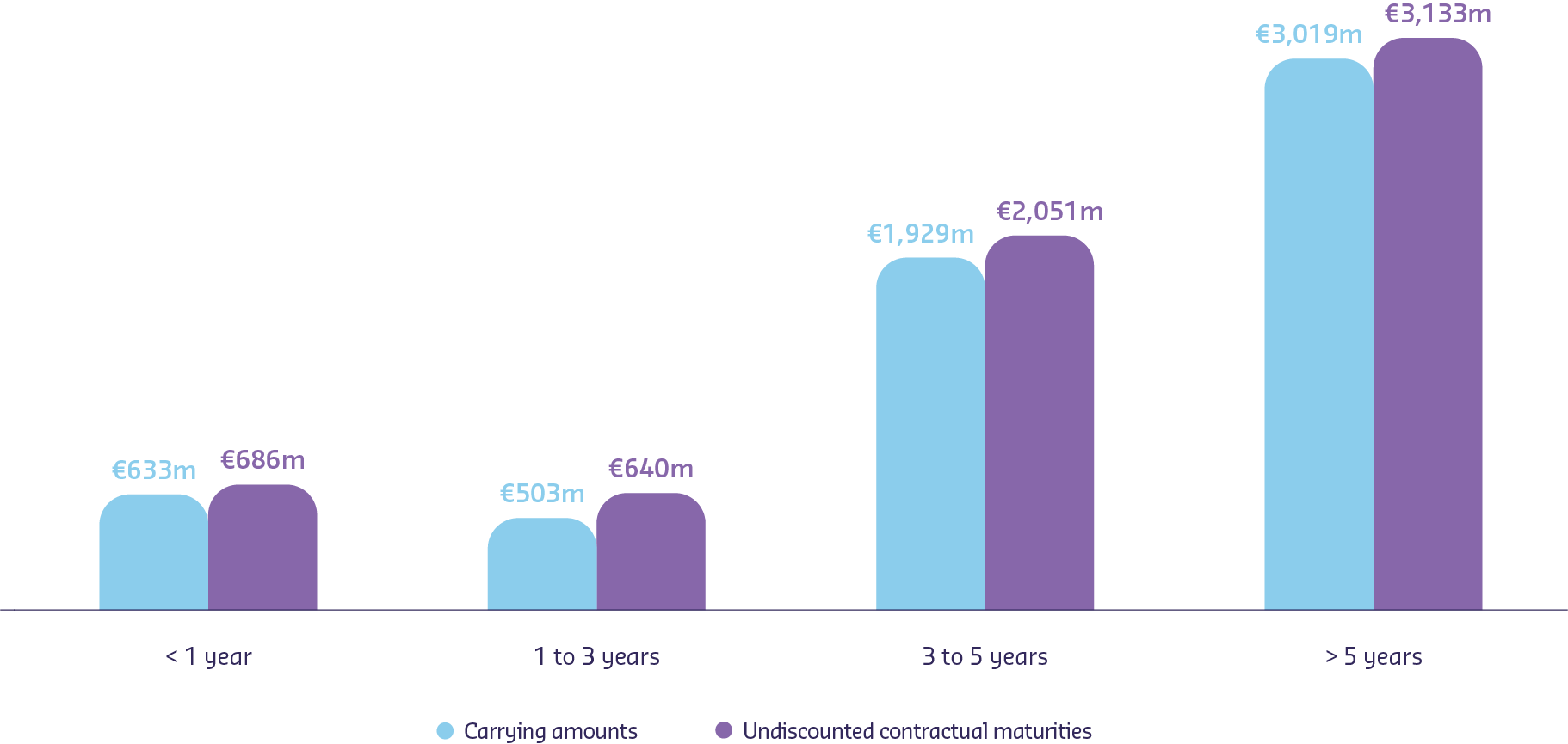

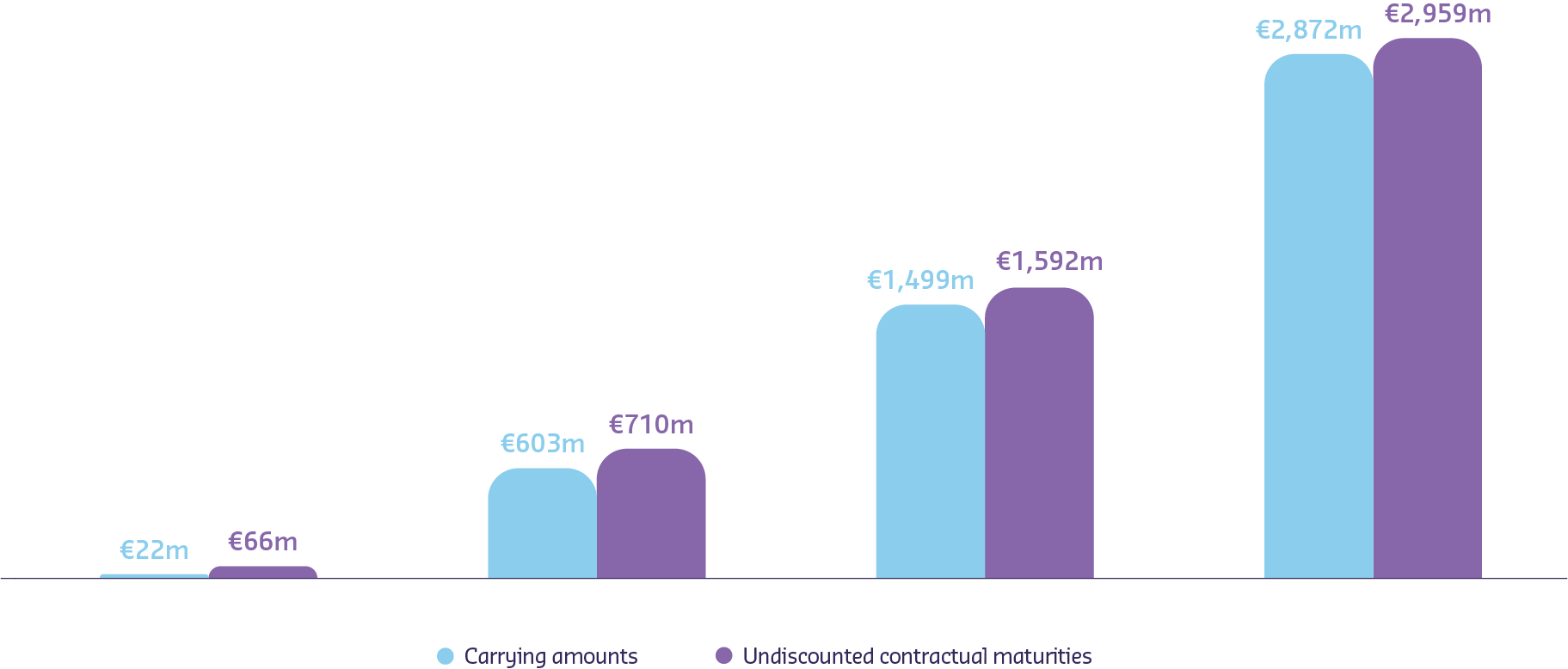

12.4.5 Maturity of borrowings

BORROWINGS EXCLUDING DERIVATIVE FINANCIAL INSTRUMENTS AS OF AUGUST 31, 2021

< 1 year : Carrying amounts : €633m, Undiscounted contractual maturities : €686m.

1 to 3 years : Carrying amounts : €503m, Undiscounted contractual maturities : €640m.

3 to 5 years : Carrying amounts : €1,929m, Undiscounted contractual maturities : €2,051m.

> 5 years : Carrying amounts : €3,019m, Undiscounted contractual maturities : €3,133m.

BORROWINGS EXCLUDING DERIVATIVE FINANCIAL INSTRUMENTS AS OF AUGUST 31, 2020

< 1 year : Carrying amounts : €22m, Undiscounted contractual maturities : €66m.

1 à 3 years : Carrying amounts : €603m, Undiscounted contractual maturities : €710m.

3 à 5 years : Carrying amounts : €1,499m, Undiscounted contractual maturities : €1,592m.

> 5 years : Carrying amounts : €2,872m, Undiscounted contractual maturities : €2,959m.

For borrowings expressed in a foreign currency, amounts are translated at the year-end closing rate

Maturities include interest accrued as of the period end. Credit facility renewal rights are taken into account to determine the maturities.

The undiscounted contractual maturities include payment of future interest not due yet.