conflicts of interest, environmental damage, document forgery or insider trading. In compliance with local laws and regulations, this system is hosted by a third-party company. All of the managers concerned have been informed of the case management and responsible investigation procedures through two online training sessions. More than 92% of case managers have been trained according to these procedures.

1,581 cases were lodged via Sodexo Speak Up during Fiscal 2021.

BREAKDOWN OF SPEAK UP CASES BY SOURCE

Employees : 93.6%

Customers/Consumers : 6%

Suppliers : 0.4%

BREAKDOWN OF SPEAK UP CASES BY CATEGORY

Employment, diversity, equal opportunities and respect : 83%

Corporate integrity, respect for privacy : 3%

Workplace health, safety and physical protection : 8%

Misuse or misappropriation of company resources : 3%

Other : 3 %

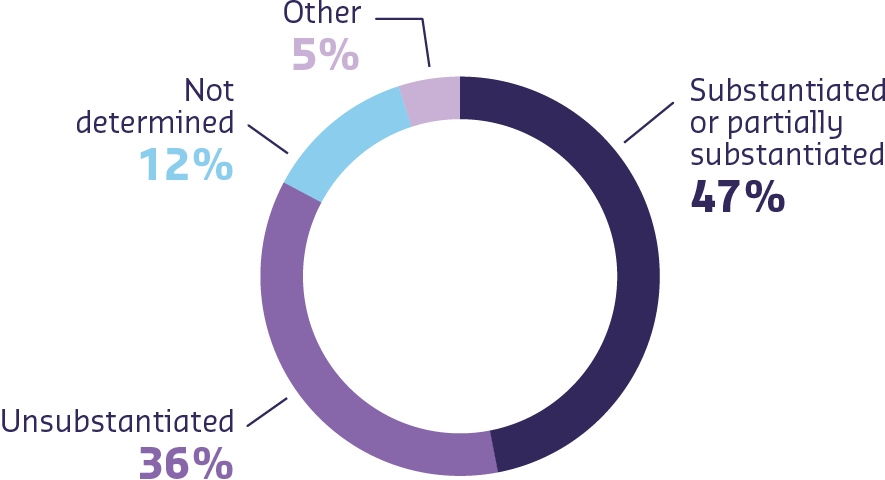

BREAKDOWN OF SPEAK-UP CASES BY RESOLUTION

Substantiated or partially substantiated : 47%

Unsubstantiated : 36%

Not determined : 12%

Other : 5%

7. Controls : the internal control and risk management procedures relating to the preparation and processing of financial and accounting information form an integral part of the Group’s anti-corruption measures. specific controls relating to Ethics, Anti-Corruption and Speak-Up are part of the annual Company Level Controls assessment, which is carried out by a very large number of Sodexo’s entities (refer to section 6.4.3.4). If an entity fails these controls, then a compulsory action plan is put in place to remedy the control deficiency. These plans are monitored by the local and regional internal control managers. Internal and external audits are performed on a regular basis, notably covering the following topics: anti-corruption, anti-money laundering, environmental protection, respect of human rights and fundamental labor rights, and occupational health and safety. In Fiscal 2021 , Group internal audit continued its audit of entities using a risk-based approach, resulting in recommendations related to improvements in Sodexo’s Ethics & Compliance program.

6.3.3.3 Sodexo Group tax policy

The Sodexo Group has established a tax policy that has been published on its website. This policy mainly states that the Sodexo Group undertakes to respect local tax laws and regulations that apply and pay its fair share of taxes in all countries where it operates, in line with the substance of the economic activity of the business locally. Sodexo is not using intended tax structures for tax avoidance nor investing in tax structures located in so-called “tax havens” in order to avoid taxes. The tax policy complies with principles of Business Integrity and the Code of ethics of the Sodexo Group. Therefore, the Group considers that it complies with the requirements of the new article L.225-102-1 of the French Commercial Code on combatting tax evasion.