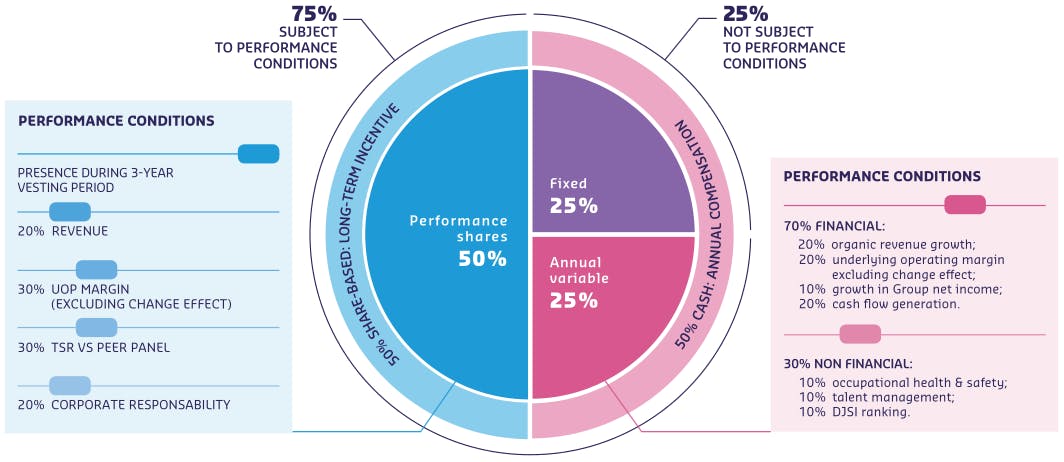

STRUCTURE OF THE CHIEF EXECUTIVE OFFICER’S COMPENSATION FOR FISCAL 2022

75% SUBJECT TO PERFORMANCE CONDITIONS

25% NOT SUBJECT TO PERFORMANCE CONDITIONS.

50% SHARE-BASED: LONG-TERM INCENTIVE.

50% CASH: ANNUAL COMPENSATION.

Performance shares : 50%

PERFORMANCE CONDITIONS

PERFORMANCE CONDITIONS

20% REVENUE

30% UOP MARGIN (EXCLUDING CHANGE EFFECT).

30% TSR VS PEER PANEL.

20% CORPORATE RESPONSABILITY.

Fixed : 25%

Annual variable : 25%

PERFORMANCE CONDITIONS

70% FINANCIAL :

- 20% organic revenue growth;

- 20% underlying operating margin excluding change effect;

- 10% growth in Group net income;

- 20% cash flow generation.

30% NON FINANCIAL:

- 10% occupational health & safety;

- 10% talent management;

- 10% DJSI ranking.

Fixed compensation

The fixed compensation of the Chief Executive Officer is awarded as payment for the duties and responsibilities inherent to such a position.

The following factors are considered :

- the level and complexity of the roles and responsibilities attributed to the Chief Executive Officer, who has the broadest powers to act on behalf of the Company in all circumstances and to represent the Company in its dealings with third parties;

- the skills, experience, expertise and professional profile of the holder of the position;

- market analyses and benchmarks on the compensation awarded for comparable positions in peer companies and their market reference.

The Chief Executive Officer's annual fixed compensation is the basis for determining his/her annual variable compensation and long-term compensation. The amount of this fixed compensation is not systematically reviewed each year.

The annual fixed compensation of Denis Machuel, Chief Executive Officer until September 30, 2021, amounted to 900,000 euro. This compensation is paid prorata temporis during Fiscal 2022, thus amounting to 75,000 euro from September 1 to September 30, 2021.

The fixed compensation of the new Chief Executive Officer will be determined by the Board of Directors in line with the aforementioned principles.

Annual variable compensation

CALCULATION METHODS

The Chief Executive Officer's annual variable compensation is intended to encourage the achievement of the annual performance targets determined by the Board of Directors in line with Sodexo's strategy.

The variable element amounts to 100% of his/her annual fixed compensation, on full achievement of targets.

It is based mainly on financial criteria, as follows:

- 70% is contingent upon targets based on the Group’s financial performance for the fiscal year, including organic revenue growth, underlying operating profit margin, Group net income and cash flow generation;

- 30% is contingent upon non-financial, quantitative targets (including occupational health and safety, talent management, Sodexo’s ranking in the Dow Jones Sustainability Index of environmental, social and governance performance).

The annual variable compensation is calculated and set by the Board of Directors following the close of the fiscal year to which it applies.

In the first quarter of each year, based on the Compensation Committee's recommendations, the Board of Directors reviews the various targets, their weightings, and the expected performance levels. It then sets :

- the trigger threshold below which no variable compensation is paid;

- the variable compensation target level, corresponding to the amount due when each target is reached; and

- the quantitative performance measure.

Consequently :

- 100% of the annual variable compensation is paid if the targets are achieved;

- 150% of the annual variable compensation is paid if the targets are exceeded.

The financial performance targets that are based on financial indicators are determined in a specific manner by reference to the budget pre-approved by the Board of Directors and are subject to the above-mentioned performance thresholds.

The achievement rates will be disclosed on a criteria by criteria basis once the Board of Directors has assessed whether the performance targets have been reached.