1. Integrated Report

Financial indicatorsFinancial indicators

MARC ROLLAND,

Group Chief Financial Officer

After a year significantly impacted by the pandemic during which Sodexo demonstrated its resilience and the relevance of its business model, our Fiscal 2021 results show a solid pick-up in activity and better than expected performance. Our actions to renegotiate our client contracts, strictly control costs and implement the GET efficiency program are clearly visible in our better-than-expected Underlying operating profit margin. At 483 million euro for the year, our free cash flow has been very positive. Our net debt ratio improved to 1.7, and liquidity is stronger than ever at 6.4 billion euro. We are also actively managing our portfolio of services and activities to enhance the Group’s performance. The recovery is continuing into Fiscal 2022, with ongoing growth and margin improvement.

EVOLUTION OF CONSOLIDATED REVENUESAND ORGANIC GROWTH

Fiscal 2017 : (Group consolidated revenues (in millions of euro) : 20,698, Organic growth(in percentage) : +1.9%

Fiscal 2018 : (Group consolidated revenues (in millions of euro) : 20,407, Organic growth (in percentage) : +1.6%

Fiscal 2019 : (Group consolidated revenues (in millions of euro) : 21,954, Organic growth(in percentage) : +3.6%

Fiscal 2020 : (Group consolidated revenues (in millions of euro) : 19,321, Organic growth(in percentage) : -12.0%

Fiscal 2021 : (Group consolidated revenues(in millions of euro) : 17,428, Organic growth(in percentage) : -5.6%

Revenues by activity

96%

On-site Services

4%

Benefits & Rewards Services

* Including Personal & Home Services.

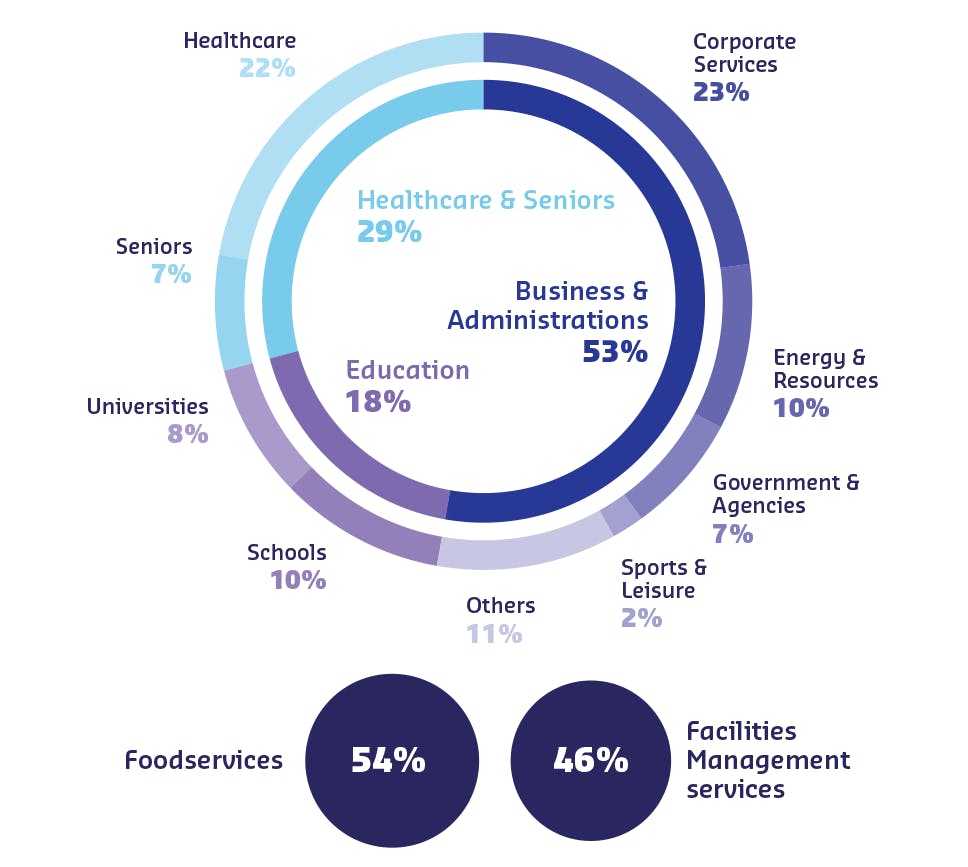

ON-SITE SERVICES REVENUES BY ACTIVITY AND CLIENT SEGMENT

23% Corporate Services

10% Energy & Resources

7% Government & Agencies

2% Sports & Leisure

11% Others

10% Schools

8% Universities

7% Seniors

22% Healthcare

53 % Business & Administrations

18 % Education

29 % Healthcare & Seniors

Foodservices

54%

Facilities Management services

46%

ON-SITE SERVICES REVENUES BY REGION

NORTH AMERICA

39%

6,514

million euro

EUROPE

42%

7,002

million euro

ASIA-PACIFIC, LATIN AMERICA, MIDDLE EAST & AFRICA

19%

3,171

million euro

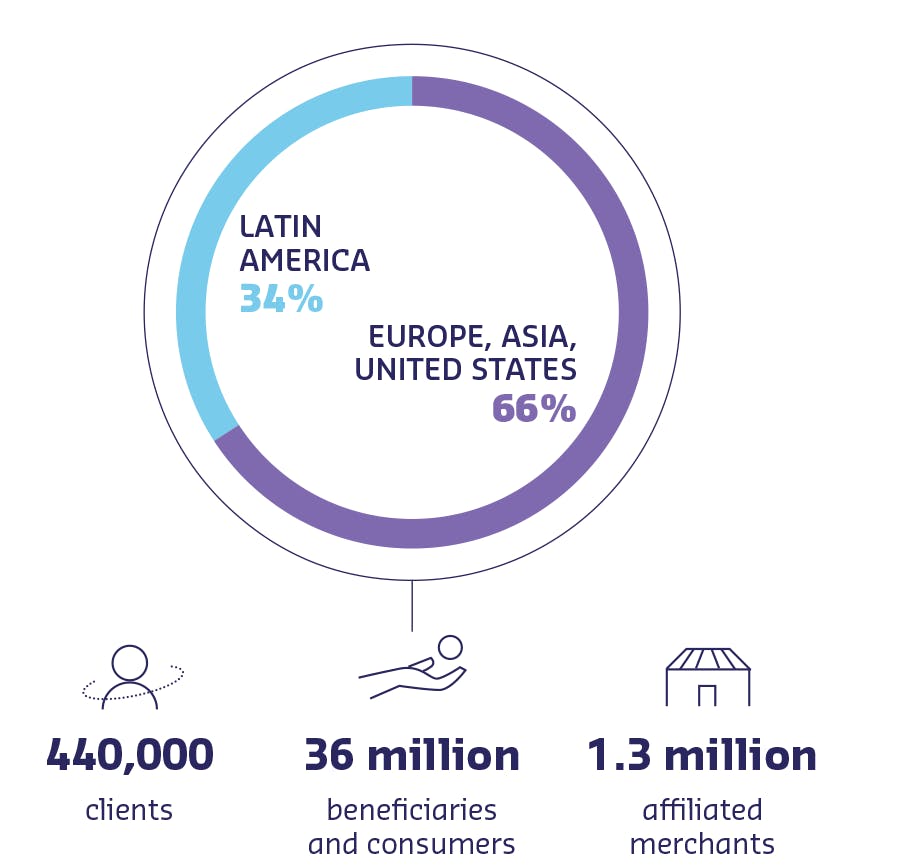

BENEFITS & REWARDS SERVICES REVENUES BY REGION*

LATIN AMERICA

34%

EUROPE, ASIA, UNITED STATES

66 %

440,000 clients

36 million beneficiaries and consumers

1.3 million affiliated merchants

* Excluding Rydoo revenues.