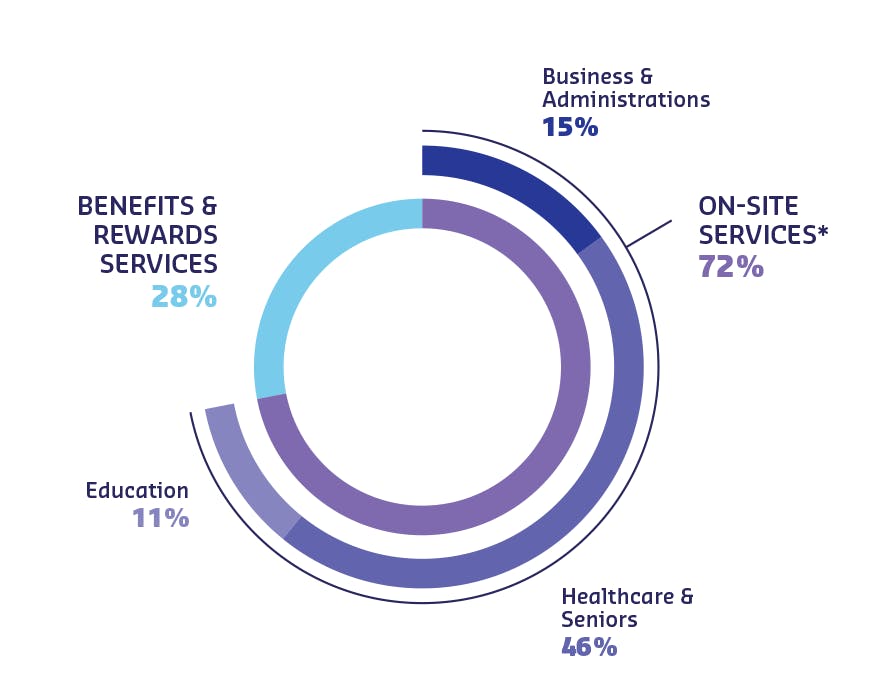

UNDERLYING OPERATING PROFIT BEFORE CORPORATE EXPENSES & INTRAGROUP ELIMINATIONBY ACTIVITY AND CLIENT SEGMENT

15% Business & Administrations

72% ON-SITE SERVICES*

46% Healthcare & Seniors

11% Education

28% BENEFITS & REWARDS SERVICES

* Including Personal & Home Services.

UNDERLYING OPERATING PROFIT AND OPERATING MARGIN

Fiscal 2017 : (Underlying operating profit (in millions of euro) : 1,340, Operating margin (in percentage) : 6.5%

Fiscal 2018 : (Underlying operating profit (in millions of euro) :1,128, Operating margin (in percentage) : 5.5%

Fiscal 2019 : (Underlying operating profit (in millions of euro) : 1,200, Operating margin (in percentage) : 5.5%

Fiscal 2020 : (Underlying operating profit (in millions of euro) : 569, Operating margin (in percentage) : 2.9%

Fiscal 2021 : (Underlying operating profit (in millions of euro) :578, Operating margin (in percentage) : 3.3%

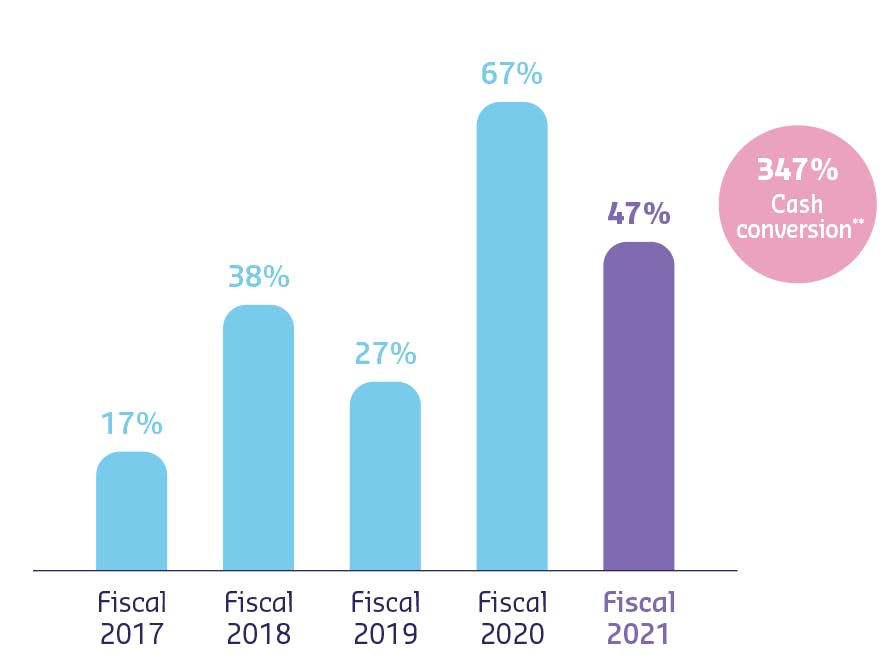

NET DEBT AS A PERCENTAGE OF SHAREHOLDERS’ EQUITY*

Fiscal 2017 : 17%

Fiscal 2018 : 38%

Fiscal 2019 : 27%

Fiscal 2020 : 67%

Fiscal 2021 : 47%

347%

Cash conversion

* Debt net of cash and cash equivalents, restricted cash and financial assets related to Benefits & Rewards Services activity, less bank overdrafts.

** Free cashflow/Net profit.

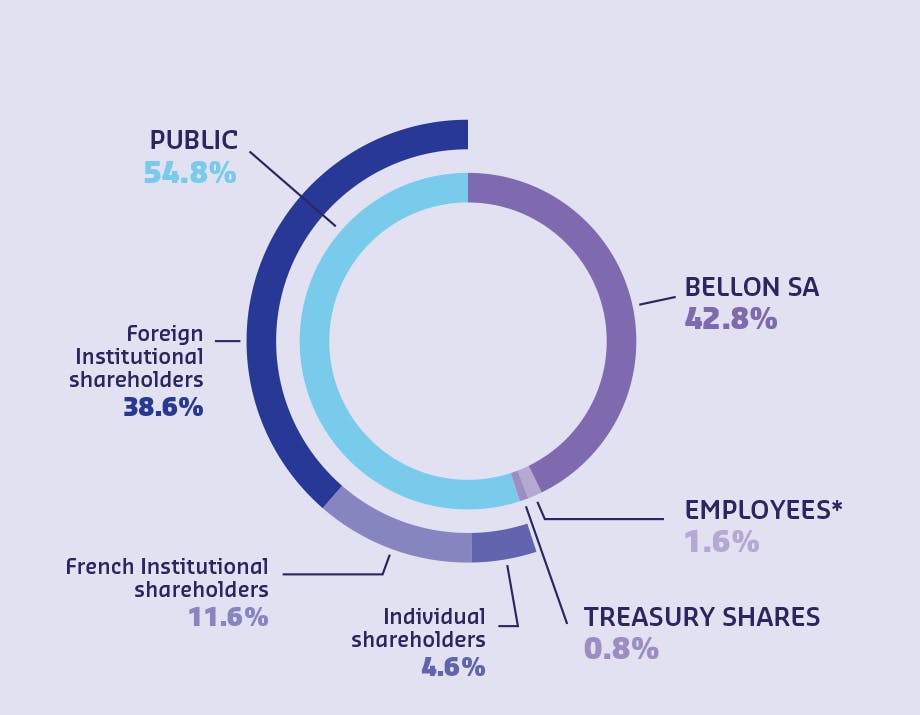

SHAREHOLDERS

AS OF AUGUST 31, 2021

BELLON SA

42.8%

EMPLOYEES*

1.6%

TREASURY SHARES

0.8%

Individual shareholders

4.6%

French Institutional shareholders

11.6%

Foreign Institutional shareholders

38.6%

PUBLIC

54.8%

Source : Nasdaq

* Including shares resulting from restricted share plans held in registered form by employees and still subject to a lock-up period

SODEXO SHARE

DATA SHEET

- Main listing place: Euronext Paris - A Compartment

- ISIN code: FR0000121220

- Mnemonic cod: SW

- Main index: CAC Next 20, SBF 120, CAC 40 ESG, Euronext 100, CAC All Share, FTSE4GOOD

- Euronext listing date: March 2, 1983

KEY INDICATORS

OF FISCAL 2021

as of August 31, 2021

- Total number of shares: 147,454,887 shares

- Closing price: 70.02 euro

- Market capitalization: 10.3 billion euro

- Sodexo share price trend during Fiscal 2021: +16.8%

- CAC 40 trend during Fiscal 2021: +35.0%

- Underlying earnings per share: 2.37euro

- Dividendper share: 2 euro*, which includes a recurring 1.20 euro

- Number of interactions/shareholders meetings: 247 meetings, 314 companies, 544 contacts.

* Submitted for approval at the Shareholders Meeting of December 14, 2021.

For more information, see chapter 3 of the Universal Registration Document.