Strategy and performance

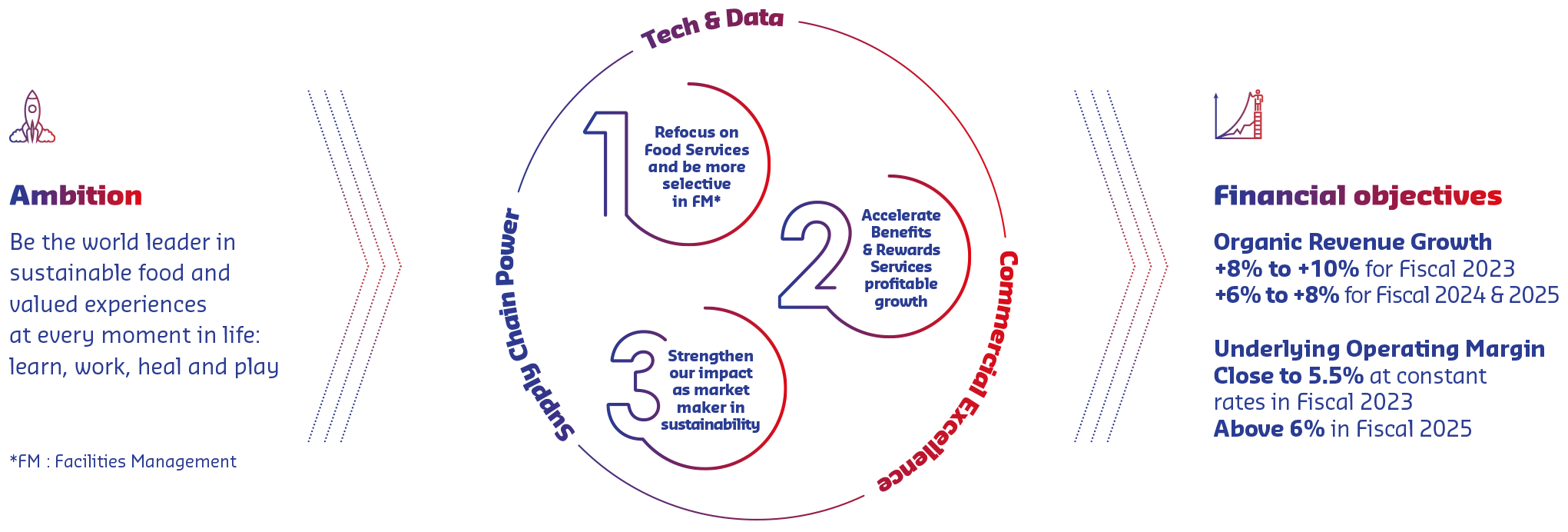

2025 strategy: refocus and accelerationCapitalizing on its strong foundation and operating in attractive, growing markets, Sodexo announced the implementation of a solid strategy built around three pillars and supported by three key enablers.

Ambition

Be the world leader in sustainable food and valued experiences at every moment in life: learn, work, heal and play

THREE KEY GROWTH LEVERS

- Tech & Data: Refocus on Food Services and be more selective in FM*

- Commercial excellence: Accelerate Benefits & Rewards Services profitable growth

- Supply chain power: Strengthen our impact as market maker in sustainability

FINANCIAL OBJECTIVES

Organic Revenue Growth

+8% to +10% for Fiscal 2023

+6% to +8% for Fiscal 2024 & 2025

Underlying Operating Margin Close to 5.5% at constant rates in Fiscal 2023 Above 6% in Fiscal 2025

*FM : Facilities Management

1. REFOCUS ON FOOD SERVICES AND BE MORE SELECTIVE IN FACILITIES MANAGEMENT

Since day one, food has been Sodexo’s DNA and the Group is recognized for its food expertise. The Group will continue to upgrade and upscale its existing food models and will accelerate the development of advanced food models to address fast-changing consumer needs and behaviors: multichannel, anytime anywhere, hybrid. The Group will reinforce its investments in convenience, aggregation and off-site production, both organically and through acquisitions. In 2025, these advanced food models will represent 10% of On-site Services food revenues, with a positive impact on profitability. With a selective approach, Sodexo will focus its Facilities Management services where they are complementary to the food experience, accretive to the business and valued by clients and consumers. These include workplace management and dynamic tech-driven cleaning for corporate clients, or infection control, healthcare technology management and patient experience in hospitals. To drive maximum value and ensure strong market coverage. Sodexo is targeting the right clients, with the right services in the right countries. Therefore, the Group is targeting growth in the most attractive value pools with the aim to be a strong number two in North America, to maintain a leading position in Europe, and to remain the number one international food player, with a higher-end positioning in Rest of the World. The Group will also continue to develop the full potential of Entegra, its Group Purchasing Organization (GPO) with a goal to double 2021 revenues by 2025.

2. ACCELERATE THE GROWTH OF BENEFITS & REWARDS SERVICES

The second strategic pillar is to accelerate the profitable growth of Benefits & Rewards Services. The employee benefits and well-being business is the highest contributor in terms of Underlying operating profit margin, with strong development potential.

Following a profound transformation which started five years ago, Benefits & Rewards Services activity is now 90% digital, and stongly positioned to support companies to enhance their employee experience. Sodexo put in place a dedicated governance for this specific tech business model to create the right conditions for growth acceleration. For the first time, Benefits & Rewards Services now has its own published objectives for Fiscal 2023 with Organic growth of +12 to +15% and Underlying operating profit margin around 30% at constant rates. For Fiscal 2024 and Fiscal 2025, growth is expected to be low double digit with an Underlying operating profit margin of above 30% in Fiscal 2025.

3. STRENGTHEN THE IMPACT AS MARKET MAKER IN SUSTAINABILITY

In line with its mission and purpose, Sodexo wants to have a positive impact on the planet and put people at the core of its business. A new role of Chief Impact Officer was created with the mission to ensure Sodexo’s purpose and values are constantly reflected in its operations and provide a competitive advantage. Sustainability underlies Sodexo’s strategy and drives the way the Group does business. Sodexo is actively continuing its journey to achieve -34% carbon emissions reduction by 2025, by extending the deployment of its WasteWatch program to 85% of its food services sites by 2025, from 46% today. To continue to address the major challenge of global warming, Sodexo has launched a process with SBTi to formalize a “science-based” 2040 Net Zero commitment, which will be a first in the sector. Recognized as a leader in Diversity, Inclusion and Equity, Sodexo is about to achieve its gender balance objectives at top management level and is targeting gender balance in 100% of its management at country level teams by 2025.

These three strategic pillars are supported by three key enablers:

-

Tech & Data

Technology investments are a critical enabler of growth. With around 500 million euros annually of IS&T, Digital and Data spend, the Group is investing in its tech infrastructure to make it a robust and secure foundation. The aim is to optimize internal and supplier business processes and applications, as well as support increased consumer focus, with more engagement, experiences and share of wallet. By 2025, Sodexo aims to have 10 million active consumers on its digital on-site ecosystem.

-

Commercial excellence

Supported by strong focus on brands and advanced food models execution, Sodexo is aiming to take client retention above 95%, key to profitable growth. Working continually on its commercial excellence, Sodexo benefits from a best-in-class CRM system and new digital sales and marketing tools (MSDC) that are making a significant difference in North America, with digital marketing leads accounting for 60% of the pipeline. The MSDC tool is currently being deployed in Europe.

-

Supply chain power

At a time of global pressure on supply chainand double digit inflation, supply chain management is key. Sodexo has been investing in people and data to improve collaboration and to optimize spend. While continuing to manage a balanced approach, with strong category management, Sodexo is driving efficiency and increasing its local, inclusive and responsible sourcing. On-site Services aim at purchasing 2 billion euros per year with SMEs by 2025 and at empowering its supply chain as a selling power machine by driving collaboration to co-build strong, innovative offers with suppliers. The Group is also continuing to develop Entegra, its GPO, in the United States and in Europe, in food & hospitality as both a profit center and a means of superior purchasing power.