Changes in the present value of the defined benefit plan obligation and the fair value of plan assets are shown below:

| FISCAL 2022 | FISCAL 2021 | |||||

|---|---|---|---|---|---|---|

| (in million euros) | BENEFIT OBLIGATION | PLAN ASSETS | NET BENEFIT OBLIGATION | BENEFIT OBLIGATION | PLAN ASSETS | NET BENEFIT OBLIGATION |

| As of August 31 | 1,435 | (1,275) | 160 | 1,476 | (1,284) | 192 |

|

Impact of changes in accounting principles(1) |

(13) | — | (13) | — | — | — |

| As of September 1 | 1,422 | (1,275) | 147 | 1,476 | (1,284) | 192 |

| Expense/(income) recognized in the income statement | 32 | (19) | 13 | 33 | (19) | 13 |

| Current service cost | 17 | — | 17 | 20 | (1) | 18 |

| Past service cost | (6) | — | (6) | (8) | — | (8) |

| Effect of settlements | — | — | — | — | — | — |

| Interest cost/(income) | 21 | (19) | 2 | 21 | (18) | 3 |

| Remeasurement losses/(gains) | (391) | 303 | (88) | 50 | (60) | (10) |

| Actuarial losses/(gains) arising from changes in demographic assumptions | 11 | — | 11 | (11) | — | (11) |

| Actuarial losses/(gains) arising from changes in financial assumptions | (404) | 303 | (101) | 59 | (60) | (1) |

| Experience adjustments | 2 | — | 2 | 2 | — | 2 |

| Currency translation adjustment | 13 | (8) | 5 | 41 | (41) | — |

| Contributions made by plan members | 2 | (2) | — | 1 | (1) | — |

|

Employer contributions(2) |

— | (82) | (82) | — | — | — |

| Benefits paid from plan assets | (37) | 40 | 3 | (44) | 41 | (3) |

| Benefits paid other than from plan assets | (13) | — | (13) | (16) | (15) | (31) |

|

Changes in scope of consolidation and other(3) |

29 | (33) | (4) | (106) | 104 | (2) |

| AS OF AUGUST 31 | 1,057 | (1,076) | (19) | 1,435 | (1,275) | 160 |

| Of which: | ||||||

| Partially funded plans | 932 | (1,076) | (144) | 1,308 | (1,275) | 33 |

| Unfunded plans | 125 | — | 125 | 127 | — | 127 |

(1) Impact of the application of IFRS Interpretation Committee decision related to IAS 19 (May 2021). See note 2.1.2 “New accounting standards and interpretations applied”.

(2) Contributions made by the employer to different plan assets of which 75 million euros of contributions to the UK pension plan assets.

(3) Including for Fiscal 2021 a benefit obligation decrease amounting to 104 million euros and assets for the same amount, linked to the retirement benefit obligations in six UK companies due to expiry of the contract.

The amounts recorded in the income statement for defined benefit plans totaled 13 million euros in Fiscal 2022 (13 million euros in Fiscal 2021) and consist of:

- net expense of 8 million euros (net expense of 8 million euros in Fiscal 2021) in Cost of sales;

- net expense of 5 million euros (net expense of 6 million euros in Fiscal 2021) in Selling, General and Administrative costs;

- net income of 2 million euros in Other Income and Expenses;

- net expense of 2 million euros in financial expenses (see note 12.1).

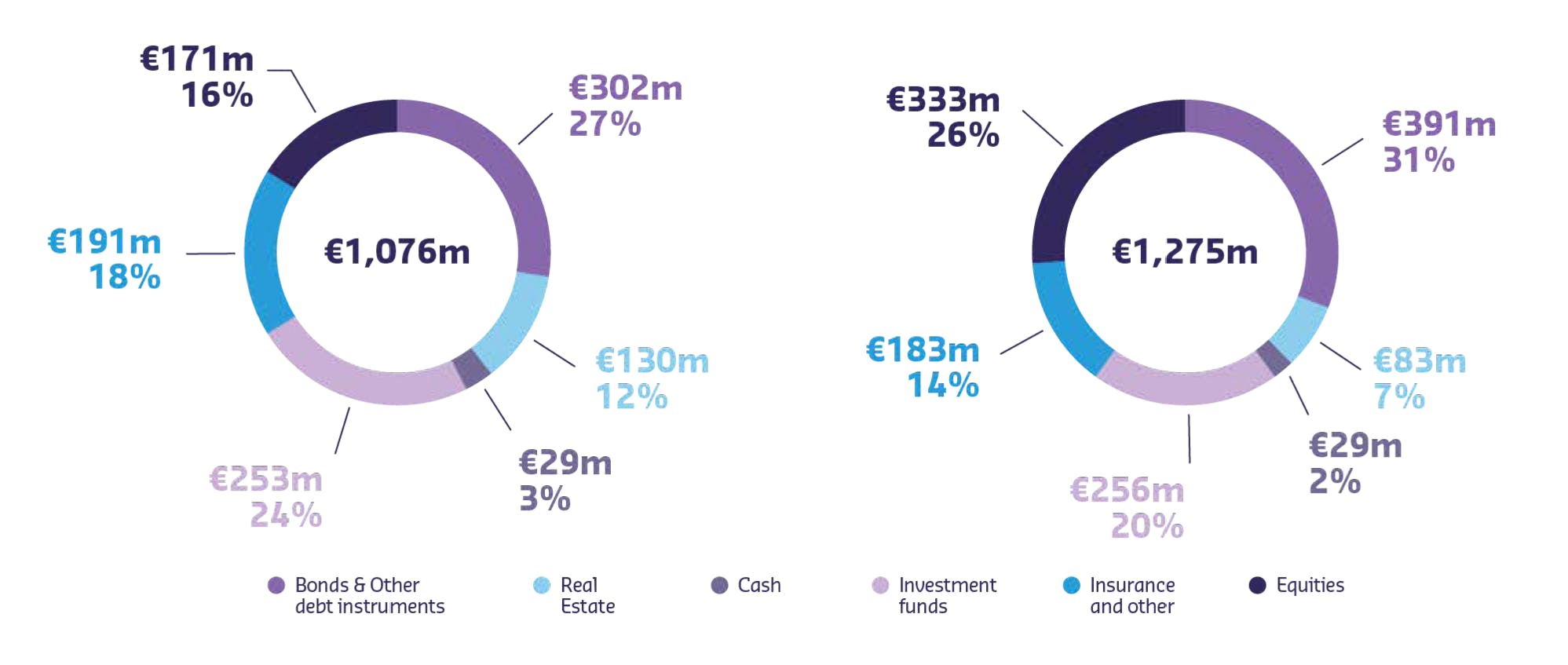

Defined benefit plan assets comprise:

As of August 31, 2022

As of August 31, 2021