12.2 Cash and cash equivalents

| (in million euros) | FISCAL 2022 | FISCAL 2021 |

|---|---|---|

| Marketable securities | Marketable securities FISCAL 2022524 |

Marketable securities FISCAL 2021329 |

| Cash* | Cash* FISCAL 20222,701 |

Cash* FISCAL 20213,211 |

| CASH AND CASH EQUIVALENTS | CASH AND CASH EQUIVALENTSFISCAL 20223,225 | CASH AND CASH EQUIVALENTSFISCAL 20213,539 |

| Bank overdrafts | Bank overdrafts FISCAL 2022(8) |

Bank overdrafts FISCAL 2021(7) |

| CASH AND CASH EQUIVALENTS NET OF BANK OVERDRAFTS | CASH AND CASH EQUIVALENTS NET OF BANK OVERDRAFTSFISCAL 20223,217 | CASH AND CASH EQUIVALENTS NET OF BANK OVERDRAFTSFISCAL 20213,532 |

* Including 10 million euros allocated to the liquidity contract signed with an investment services provider, which complies with the Code of conduct drawn up by the French financial markets association Association française des marchés financiers – AMAFI) and approved by the French securities regulator (Autorité des marchés financiers – AMF), for the purpose of improving the liquidity of Sodexo shares and the regularity of the quotations.

Marketable securities comprise:

This diagram shows the marketable securities

As of 31 August 2022

€524m in total

Mutual funds and other hold €21m for 4%.

Term deposits hold €123m for 23%.

Short-term notes hold €380m for 73%.

As of 31 August 2021

€329m in total

Mutual funds and other hold €14m for 4%.

Term deposits hold €124m for 38%.

Short-term notes hold €190m for 58%.

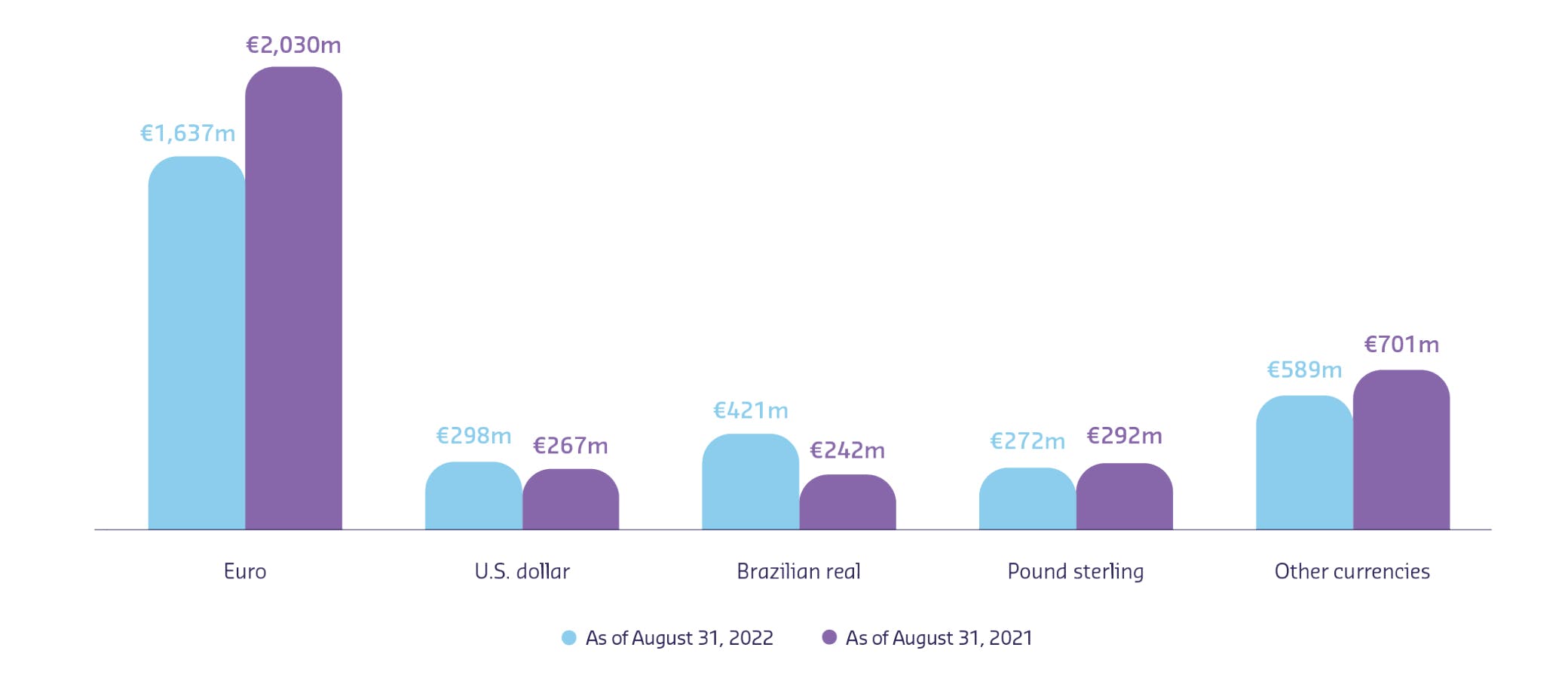

Cash, cash equivalents and overdraft break down as follows by currency:

This graph shows the cash, cash equivalents, and overdraft break down as follows by currency:

As of August 31, 2022

Euro: €1,637m

U.S dollar: €298m

Brazilian real: €421m

Pound sterling: €272m

Other currencies: €589m

As of August 31, 2021

Euro: €2,030m

U.S dollar: €267m

Brazilian real: €242m

Pound sterling: €292m

Other currencies: €701m

This currency allocation is presented after clearing the positive and negative positions of the Group's two cash pools with an asset position of 2,710 million euros and a liability position of 17 million euros as of August 31, 2022.

More than 85% of the Group’s cash and cash equivalents, restricted cash and financial assets related to the Benefits & Rewards Services activity, is held with A+, A1- or A2-rated financial institutions.

No significant amount of cash or cash equivalents was subject to any restrictions as of August 31, 2022.